stock option exercise tax calculator

Exercising stock options and taxes. This benefit should be reported on the T4 slip issued by your employer.

The taxable benefit is the difference.

. Calculate the costs to exercise your stock options - including taxes. Calculate the costs to exercise your stock options - including taxes. Get side-by-side comparisons of different plans for your equity in 10 minutes or less.

The rest of the numbers are the same as before. When you exercise your employee stock options a taxable benefit will be calculated. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

The tax implications of exercising stock options. Stock Option Tax Calculator. Exercise incentive stock options without paying the.

Your taxes will be paid on 10 minus 5 equaling 5 per. When your stock options vest on January 1 you decide to exercise your shares. On this page is a non-qualified stock option or NSO calculator.

For every 1 beyond the phase out amount the exemption amount is reduced by 025. Then can get as much as 10x higher than the strike price you pay to actually. Incentive stock option iso calculator.

Discover Helpful Information And Resources On Taxes From AARP. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. You already paid 261000 when you exercised.

NSO Tax Occasion 1 - At Exercise. Calculate the costs to exercise your stock options - including taxes. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options.

Ad Our Resources Can Help You Decide Between Taxable Vs. Calculate the costs to exercise your stock options - including taxes. Exercising your non-qualified stock options triggers a tax.

Youve made a 81 net gain on your NSO 150 52 sale tax 17 exercise cost If you sell all of your 15000 NSOs then. The stock price is 50. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your.

Cash secured put calculator addedcsp calculator. This calculator illustrates the tax benefits of exercising your stock options before IPO. Exercise tax bills can become pretty extreme.

Exercise incentive stock options. This permalink creates a unique url for this online calculator with your saved information. Click to follow the link and save it to your Favorites so.

Please enter your option information below to see your potential savings. Stock Option Tax Calculator. The Stock Option Plan specifies the total number of shares in the option pool.

On this page is an Incentive Stock Options or ISO calculator. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Our Stock Option Tax Calculator automatically accounts for it.

For example a single person who has AMTI of 525000 will only have 72900 - 525000 -. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. Ad Calculate the impact of dividend growth and reinvestment.

Taxes for Non-Qualified Stock Options. Get side-by-side comparisons of different plans for your equity in 10 minutes or less. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Exercise incentive stock options without paying the alternative minimum tax. You pay the stock. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

It requires data such as. Your stock options cost 1000 100 share options x 10 grant price. Say in total you have 15000 ISOs.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Heres a real-life example. How much are your stock options worth.

Lets say you got a grant price of 20 per share but when you exercise your. Exercise incentive stock options. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Secfi Alternative Minimum Tax Calculator

How To Use The Exercise Simulator In Your Carta Portfolio

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

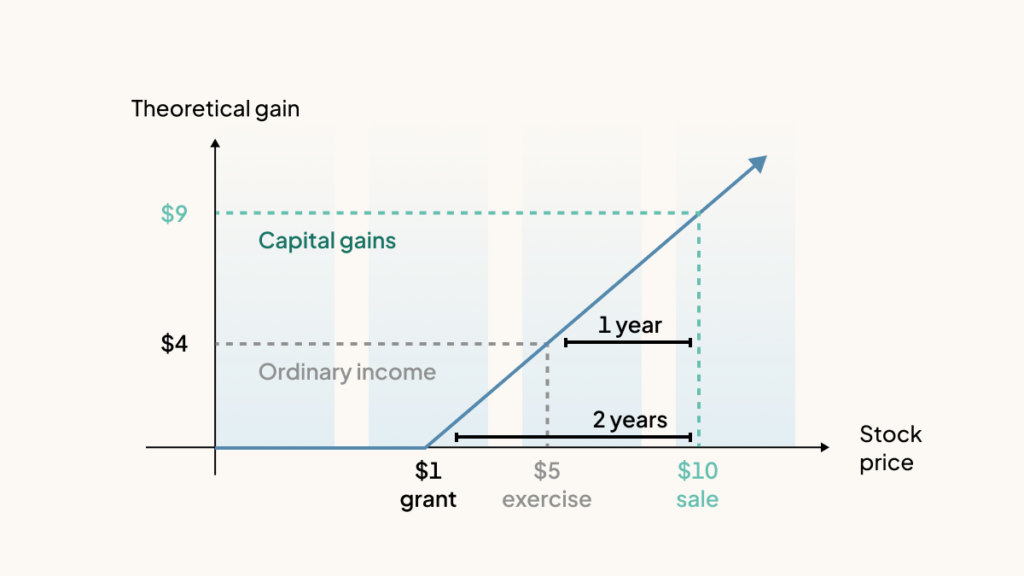

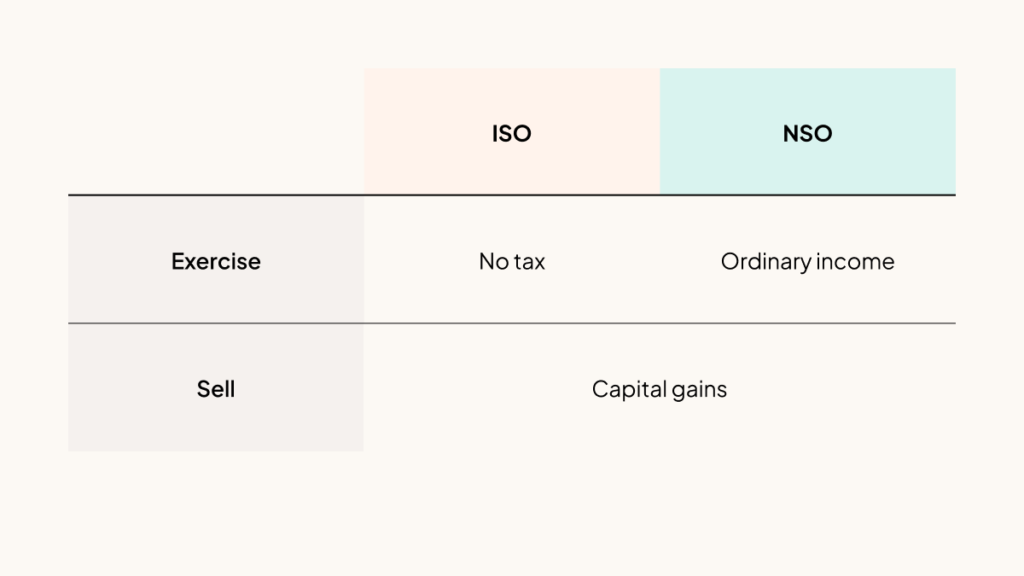

How Stock Options Are Taxed Carta

Employee Stock Options Financial Edge

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

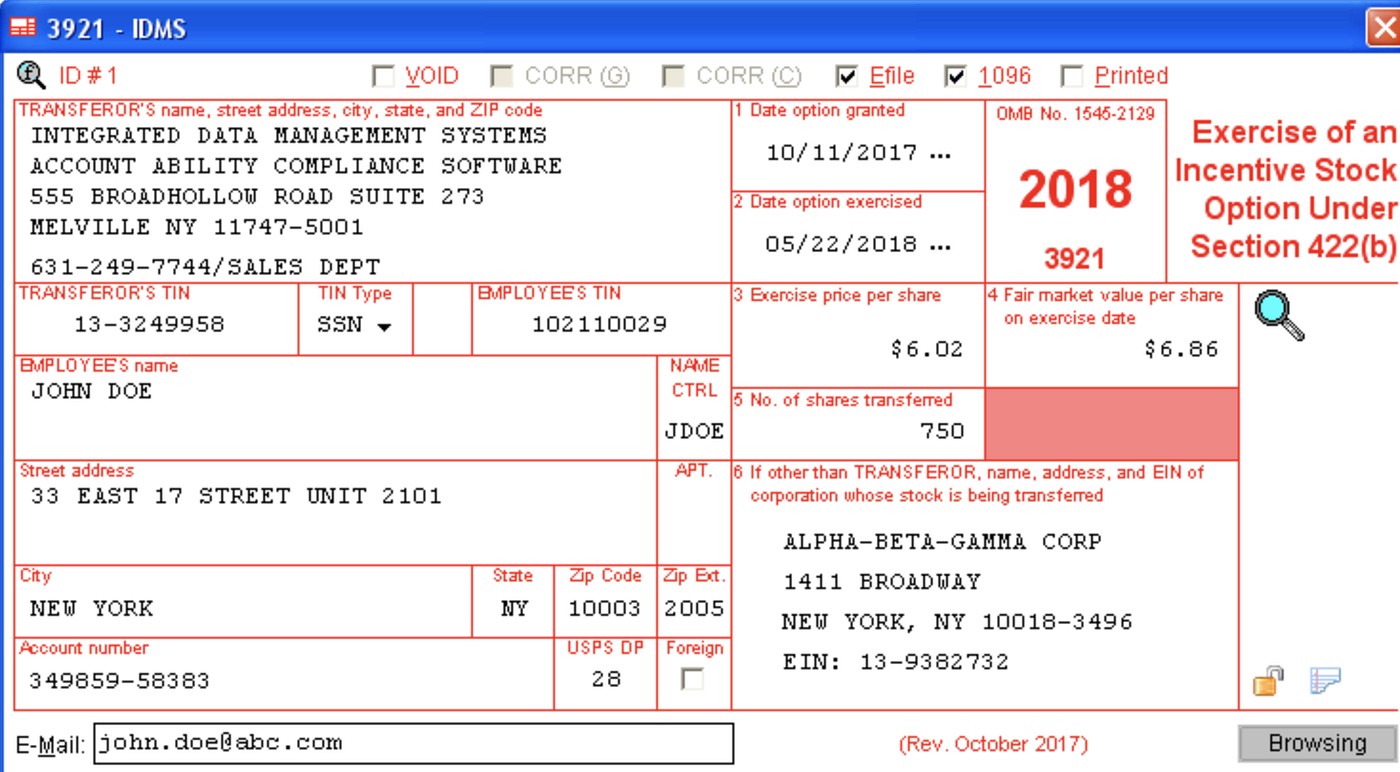

Did You Exercise Your Stock Options Last Year Here Is What You Need To Know By Jina Kim Medium

Tax Planning For Stock Options

Opening An Nre Fixed Deposit Compare Interest Rates Among Banks Nri Saving And Investment Tips Investment Tips Investing Savings And Investment

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Stock Options 101 The Essentials Mystockoptions Com

How Stock Options Are Taxed Carta

Exercise Cartoon 808 Andertoons Exercise Cartoons Gym Humor Biking Workout Gym Clothes Cheap